The 2025 Annual enrollment period (AEP) marked a major shift in the Medicare Advantage (MA) market. For the first time, many of the largest insurers focused more on profitability than on membership growth. This move, cited as “margin over membership” by Aetna CFO Tom Cowhey, led to benefit cuts and more careful plan expansions. This approach was also taken by Humana and United Healthcare.

AEP 2025 set the stage for a more conservative approach early on. There was an unprecedented absence of “first looks,” signaling a cautious, strategic season that led major insurers to keep their cards close to their chest. Ultimately, this secrecy revealed widespread benefit cuts as insurers prioritized sustainability over expansion.

AEP 2025 was one of the most unpredictable and dynamic enrollment periods in recent years, and its impact is still being felt:

- MA enrollment surpassed 50% of eligible seniors in 2024

- 54% enrollment rate indicating a maturing market

- Projected growth rate of 3.8%, similar to 2007

As we look ahead to AEP 2026, marketers need to take stock of the changes from the last AEP and prepare for another fast-paced and competitive year.

Jump To:

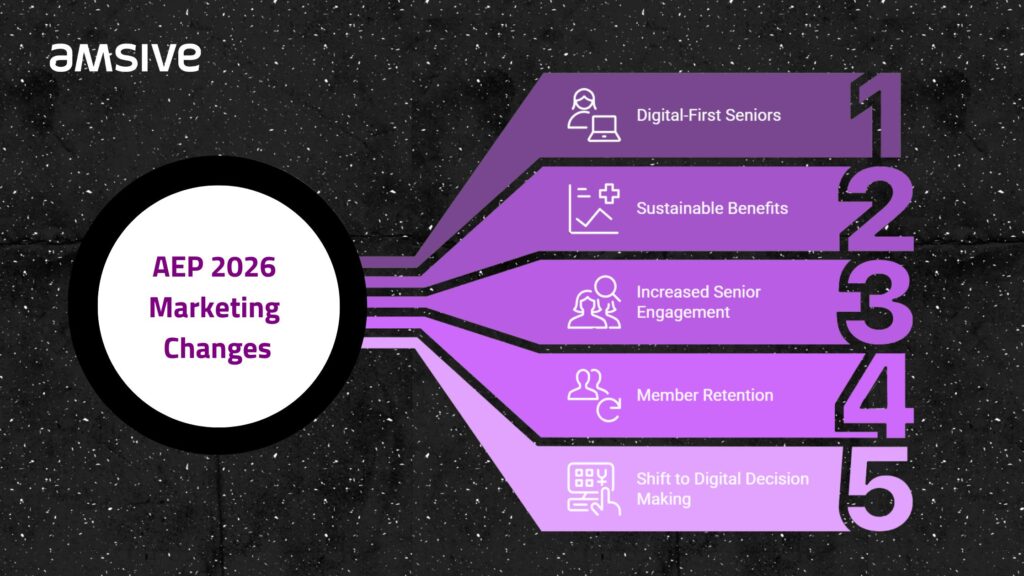

What changes are impacting AEP marketing in 2026?

Digital-first seniors are taking charge of their healthcare elections. More beneficiaries are now relying on online tools and resources to explore and compare Medicare Advantage plans. This shift from traditional methods, such as direct outreach, to digital channels has changed how insurers market their plans.

Providers are trying to make costs more sustainable

One of the most notable shifts during AEP 2025 was the focus on sustainable benefits over expansive growth. Both large and small plans reevaluated their offerings, opting to reduce existing benefits rather than aggressively pursue membership growth.

Why does it matter? This change reflects a strategic move towards long-term stability, ensuring that insurers can provide meaningful benefits while maintaining financial sustainability.

Seniors are actively evaluating their options

A significant change in AEP 2025 was the increase in senior engagement, especially with Annual Notice of Change (ANOC) documents. In 2024, more than 80% of seniors read their ANOCs—well beyond the typical 50%. This surge in engagement reflects a growing desire for clarity about benefits and greater awareness of available options. Beneficiaries are actively researching their options, and the rate of plan switching reached its highest point in a decade.

Why does this matter? More seniors are willing to make changes if they feel better informed. This means insurers must communicate effectively to maintain their members.

Member retention is as important as acquisition

While attracting new members remains important, retaining existing ones is now just as critical. Insurers that focused on retention strategies and providing better member experience saw improved stability and long-term growth. Today, retention is about more than just offering the lowest premium—it’s about making sure members feel valued and supported all year round.

Why does this matter? Retaining members requires ongoing engagement and clear communication, not just competitive pricing.

Seniors are pivoting to digital-first decision making

While direct mail remains a key channel for communication, more seniors are turning to online tools and social media to explore Medicare Advantage plans before contacting brokers. A growing number are enrolling directly through websites and digital platforms, bypassing traditional methods entirely.

An important factor here is social listening. Seniors are increasingly sharing their thoughts and experiences online, making it vital to monitor these conversations. By listening to what they’re saying, insurers can gain valuable insights to fine-tune their strategies.

Why does this matter? Digital platforms are taking center stage in marketing strategies. A multichannel approach—where digital and traditional channels complement each other—is now essential.

Local and regional Medicare Advantage plans are gaining market share

In a surprising twist, local and regional plans gained traction in AEP 2025. With national carriers pulling back from certain markets due to tighter margins, smaller, regional plans were able to capture new beneficiaries. This shift means localized marketing strategies are becoming more effective, with regional players taking advantage of disengaged members from larger competitors.

Why does this matter? Smaller plans have the chance to build strong relationships with local communities and position themselves as an alternative to larger, less flexible players.

Strategies to align your Medicare Advantage marketing with emerging digital trends

Although direct mail remains a key channel in Medicare Advantage marketing, more seniors are taking immediate action online after receiving mail. They’re researching, reading reviews, and searching for additional plan information. This shift in behavior means that insurers must ensure their digital presence is not only visible but also user-friendly and aligned with the expectations of tech-savvy seniors.

Drive results: Make sure your website is easy to navigate and provides all the information seniors might need to make informed decisions.

Understand how seniors are moving through research, comparison, and enrollment

In the past, brokers were often the first point of contact for seniors making Medicare Advantage decisions. Now, many seniors are turning to digital resources for comparison and enrollment. Tools driven by artificial intelligence (AI) are making it easier for seniors to enroll independently, without assistance from brokers. Self-service is beneficial for both seniors and insurers. It makes the enrollment process faster and more convenient while reducing operational costs for insurers.

Drive results: Offer self-service enrollment to improve convenience for seniors and reduce insurer expenses.

Gain a critical competitive advantage with multichannel marketing

While digital tools are on the rise, traditional channels like direct mail still play a vital role. A seamless experience across all these channels is essential. Beneficiaries who interact with a piece of direct mail should be able to easily transition to online research, and ultimately, to self-enrollment, a phone call for assistance, or a meeting with a broker.

Drive results: Create a unified customer experience across all channels to meet seniors wherever they are in their decision-making process.

Focus on retention & member experience

With retention now a top priority, insurers must invest in strategies that keep members happy and loyal. Predictive analytics can help identify members who are at risk of switching plans, allowing insurers to reach out proactively with tailored communication.

Drive results: Enhance customer service and maintain strong communication throughout the year to build loyalty.

Optimize digital channels and integrate AI

Digital tools must be optimized for conversions. Seniors expect websites to be easy to navigate, and AI-driven tools can provide personalized customer journeys. Plans that integrate these technologies will have a competitive edge in engaging the growing digital-first senior population.

As you add and improve digital channels, it’s important to stay on top of privacy and compliance rules, like HIPAA and CMS guidelines. Protecting seniors’ personal and health information should always come first, so make sure you’re using secure practices and that your AI tools are in line with privacy standards.

Drive results: Prioritize conversion rate optimization (CRO) to ensure that your website is set up for success in driving online enrollments.

Target local and regional market expansion

With national players pulling back, local and regional plans can take advantage of new opportunities in underserved markets. By tailoring marketing messages to specific senior segments, regional plans can build brand recognition and trust within local communities.

Drive results: Focus on high-growth areas and create hyper-localized marketing campaigns that resonate with the senior population in these regions.

Prepare for regulatory and competitive changes

Staying ahead of regulatory changes is crucial. As the Centers for Medicare & Medicaid Services (CMS) continues to evolve rules and regulations, insurers have to be prepared to adapt. Monitoring AI-driven search trends will also help ensure visibility on platforms like Google, where many seniors begin their search for Medicare Advantage information.

Drive results: Regularly update your marketing and messaging to stay compliant with new regulations and competitive within the market and prepare for this year’s AEP.

Gearing up for AEP 2026

Looking toward AEP 2026, it’s clear that digital transformation will continue to shape the Medicare Advantage landscape. Remember:

- Seniors are becoming more tech-savvy and prefer self-service options.

- Insurers need to blend digital tools, AI, and omnichannel strategies.

- Local plans can focus on community engagement and personalized outreach.

The upcoming enrollment period promises to be highly competitive. By embracing these trends and adjusting your marketing strategies to meet the needs of today’s seniors, you can be prepared for the changes ahead.

Marketing is evolving at breakneck speed, and 2025 is set to redefine the game. Explore the five biggest digital marketing transformations for 2025 in our latest webinar, or let’s talk about how Amsive can help you future-proof your marketing strategy.