Investing in customer knowledge means your marketing can be targeted with complete precision.

One of the most important performance metrics for the success of your bank or credit union’s marketing is also one of the most overlooked. It’s efficiency ratio, and the data shows it’s one of the key differentiators between the top-performing financial institutions and the also-rans.

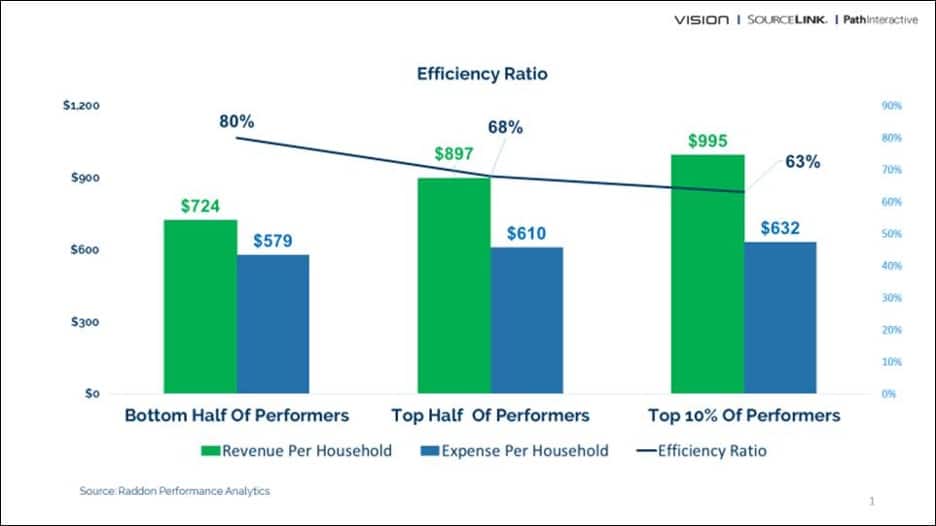

This key gauge compares expenses to revenue — how much the bank or credit union spends to make a dollar. The lower the percentage number, the better. As you can see in the chart below based on data from Raddon Performance Analytics, the top-performing institutions at 63 percent spend 63 cents for every dollar of revenue they generate per household. The bottom half of performers spend 80 cents for each dollar of revenue.

A Strategic Investment That Works

Increasing efficiency ratio by cutting expenses to the bone doesn’t work in today’s complex environment. The top-performing banks and credit unions don’t get these superior results by cutting their expenses per household. Instead, and perhaps surprisingly, you can see that they spend more — and those dollars go a lot further in producing results.

The key is how and where you spend those dollars. A strategic investment in building stronger, more multifaceted relationships with the right households is the best bet. This means starting with data. Today it is possible to effectively augment your existing customer data with advanced data science to know how to drive more profitable household relationships.

While financial institutions dipping their toes into these waters for the first time are often reluctant to share their first-party data[amsive_tooltip term=”first-party-data”] to combine it with third-party data[amsive_tooltip term=”third-party-data”], they won’t get far without it. Because it’s the synergy between this existing customer data and identity and credit bureau data that together gives you a much fuller picture of your most promising existing customers and their needs.

Increasing efficiency ratio by cutting expenses to the bone doesn’t work in today’s complex environment.

Using this approach, you’ll gain a clearer picture of your customers. You will understand who they are, what they buy and what they are interested in. You will also learn their media preferences, financial situation, and their propensity to purchase or borrow. Amsive works with banks and credit unions who initially assume that this level of data analysis and customer insight is beyond their reach and their budget. But it isn’t.

Strike When Opportunity Knocks

With this knowledge, you will have the data you need to target the right households at the precise times when they need a financial solution. For example, you will know when they are actively seeking a mortgage, auto loan, HELOC for a remodel, or other financial service that allows you to broaden and deepen your relationship with these customers.

When you invest in customer knowledge first, your marketing can be targeted with complete precision to move the specific levers that improve revenue per household. When you know your customers’ specific needs, preferred communication channels[amsive_tooltip term=”media-channel”], financial situation and other data, you can reach each household with very targeted offers precisely at the critical decision points when they’re most open to them. And when your marketing goes from a “spray and pray” approach to a highly strategic, laser-focused one, you can achieve significantly better results in terms of efficiency ratio.

An Integrated Approach

Amsive helps clients do this by interpreting the signals your customers give off that highlight an immediate need for additional financial products. Our media experts and creative team help you reach the right people in their preferred channels at these opportune times with offers that resonate. We round out this strategic approach with program measurement and optimization to enable you to improve your messaging and results continually. With a slight uptick in investment, this approach yields efficiency ratio increases that, in turn, will improve your bank’s marketing and corresponding performance over time.