Ignite new membership growth with a stronger audience strategy for your age-in prospects.

As more than 10,000 Americans become eligible for Medicare each day, insurers are challenged to identify and win over the right people — far in advance. A complete, correct picture of your best audience allows insurers to find more people with similar attributes as your best customers before they are even eligible to enroll.

Changes such as third-party cookie deprecation have sped up the timeline for insurers to dig into their audience data. But knowing the demographic, psychographic, and behavioral attributes of your best members means you’re only targeting the ideal people and, in turn, improving your marketing performance.

Regardless of channel, from direct mail to streaming TV and radio to paid search, connecting the value of your offering to the people most likely to enroll starts with deeply knowing your audience. Learn more about the realities of people aging into Medicare today and how to harness those insights to develop a fuller audience strategy.

Why Are More Americans Continuing to Work?

The path to retirement has been changing. For insurers, age-in Medicare marketing is a high-value part of your enrollment strategy, but more than half of workers plan to keep working past retirement age.

People are delaying retirement and sticking with their group insurance due to a range of factors, including:

- Boosted Income: Working for a few more years beyond the retirement date, or drawing fruitful Social Security benefits later, tends to significantly boost income. Depending on each person’s financial situation, delaying retirement even a few years can make a significant impact on someone’s quality of life throughout retirement.

- Longer Lifespan: The original Social Security Act of 1935 set the minimum age for receiving full retirement benefits at 65. Since the program first began, the average life expectancy for men has risen to 73 years; women’s average life expectancy has increased to 79. People are living longer, pensions are less common, and most Americans have to manage their own retirement savings with more years to pay. As a result, some Americans work longer.

- Financial Pressures: Whether it’s post-Great Recession woes, dealing with the economic fallout from the COVID-19 pandemic, or other factors, money issues are driving many employees to retire later. According to AARP research, workers in their 50s feel they will have to postpone their retirement by years due to a lack of pension savings and high levels of debt.

- Job Satisfaction: According to an AARP study, many seniors continue working not for money but for the love of working. Work can become a fixture and pillar in someone’s life, and with advancements in healthcare and technology, it’s more feasible for people to continue working longer than they may have in the past.

When you’ve identified potential members within your best audience of age-in prospects, you can develop messaging and creative to nurture people as they continue to work past the normal age of retirement.

Medicare marketers should speak to the everyday realities of their best prospective audience, sharing unique value as people age in to enrollment over time.

Other Impacts On The Retirement Age

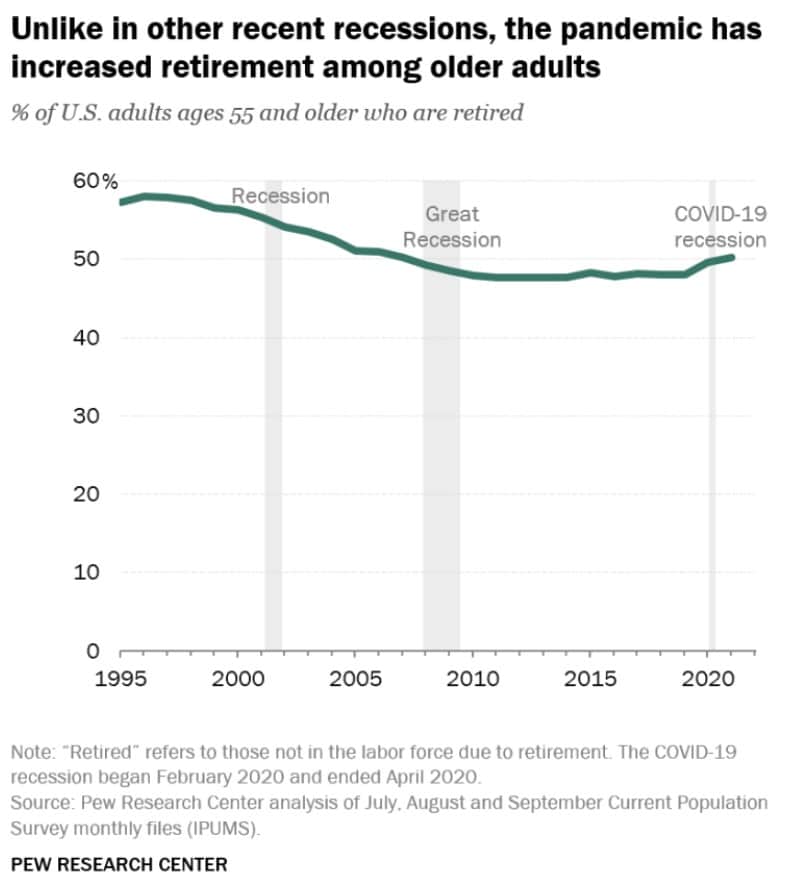

According to data from the Pew Research Center, retirement among older Americans increased during the early part of the pandemic to more than 50% of people 55 and older. A key reason cited for this is that, unlike in the years following the Great Recession, the value of assets — property and housing assets in particular — significantly rose. Keeping an eye on the housing market and stock market could offer insight into other trends ahead with this demographic. Housing experts have varied opinions on exactly what the future will bring, but a believed leveling out of inflation, improvements to supply chain issues, and a likely increase in new construction in the coming years will have an impact on retirement plans for a large percentage of the population moving forward.

Prioritize Data to Understand Your Audience

Understanding your audience is a key step toward identifying your best prospective members and is something that marketers have used as a foundation for their audience strategies for years. Harnessing your first-party data is an important part of this, but it isn’t the only aspect you need to focus on to build a complete picture.

By taking this data and supplementing it with recent retirement trends, audience insights, and other data that directly relates to your target audience, you can build lookalike audiences in order to identify prospective members that share the same traits and create a more complete picture of exactly who you should be targeting in your marketing efforts. Some key attributes that can help you determine the likelihood of retirement for potential members include:

- Age

- Household makeup

- Income

- Net worth

- Occupation

As third-party data is being phased out, it’s important to build a plan for how you can overcome this potential obstacle. Collecting and compiling first-party data needs to be part of your strategy if it isn’t already. With it, and with the effective implementation of additional data sources, you can build a more robust picture of your ideal member and which channels are the most effective in reaching them.

Gain a Clearer Picture with Predictive Modeling

Effectively using proprietary data models is important to identifying people as they approach retirement age and ensuring the right message reaches them at the right time. Not only does this help you ensure the maximum impact of your messaging, but it can also help you be more efficient with your marketing dollars by focusing your spend where it is most effective.

By supplementing your first-party data with additional datasets, you can assess your potential audiences to create a more accurate targeting model to better position your products and services in front of the people you want to reach.

In the past, this type of data may have been out of reach for smaller businesses or for businesses with a more limited marketing budget. In today’s data-rich environment, there are numerous tools available to you and to your marketing partner that can grant you access to additional first-party databases and walled garden platforms to gain access to cutting-edge information.

With more than 10,000 Americans reaching Medicare eligibility every day, insurers need to effectively leverage their data to identify and target their ideal prospective members. Even the platforms available to reach people are changing on an increasingly rapid basis, and understanding which one works best for your audience is a vital step in implementing an effective marketing campaign.

Accelerating your age-in marketing strategies is only one part of a data-centric, performance-driven strategy, giving you the power to know more and do more. Dig deeper into paid media targeting options that go beyond relying on third-party cookies, or let’s talk about how to achieve more for your marketing—and your business.

Author: Ryan Smythe, Content Manager