Our clients achieve

the big wins.

The results are in. We amplify business growth — with big-picture strategy and hands-on partnership.

Search our work:

National Property & Casualty Insurance Carrier

Leveraging our proprietary audience approach, we transformed this national insurance carrier’s marketing, achieving personalization and relevancy, and reducing cost per bind.

Midwest Regional Plan

Our data-driven creative strategies broke through national benchmarks in the Medicare Advantage market, resulting in groundbreaking campaign performance.

ZOA Energy

Our innovative tactics elevated this ecommerce brand into the top 1% of all Shopify stores in record time, achieving a remarkable rise in ROI.

East Coast Mid-Tier Bank

Our unique multichannel approach turned a critical challenge for this bank into an incredible success story of growth and customer loyalty.

Global Media Company

Amid Google core updates and increased competition, we helped this publisher boost traffic and brand visibility with an in-depth SEO strategy.

Casual Dining Restaurant Chain

Amsive transformed a major casual dining chain’s diverse goals into a unified strategy, delivering both in-store and online growth through tailored, data-led tactics.

Voss Water

Leveraging an insight-driven multichannel strategy, we rejuvenated this luxury brand, driving a 20% sales increase in target markets in just three months.

A Top-25 Credit Union

We used an audience-led approach to transform this community credit union’s membership challenges into a 22% rise in checking account conversions.

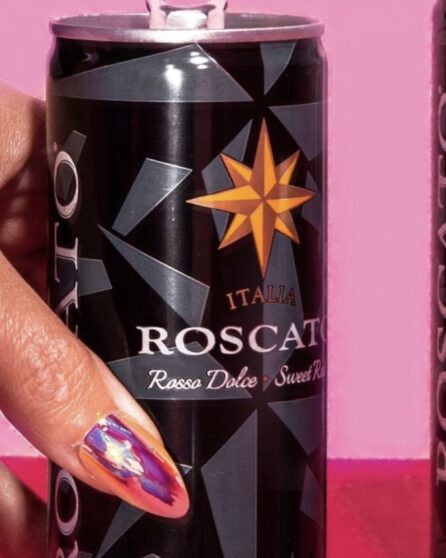

Roscato Wine

We crafted a 360-degree strategy to overcome market challenges and swiftly lead this wine brand to success in a crowded category.

5-Day Immune Boost Pack

Our unique audience-centered approach and strategic influencer marketing elevated this brand’s consumer awareness and Amazon sales during peak season.