Personalized and compelling offers to a currently unprofitable customer at their exact moment of need can quickly turn an unprofitable customer into a highly valued one.

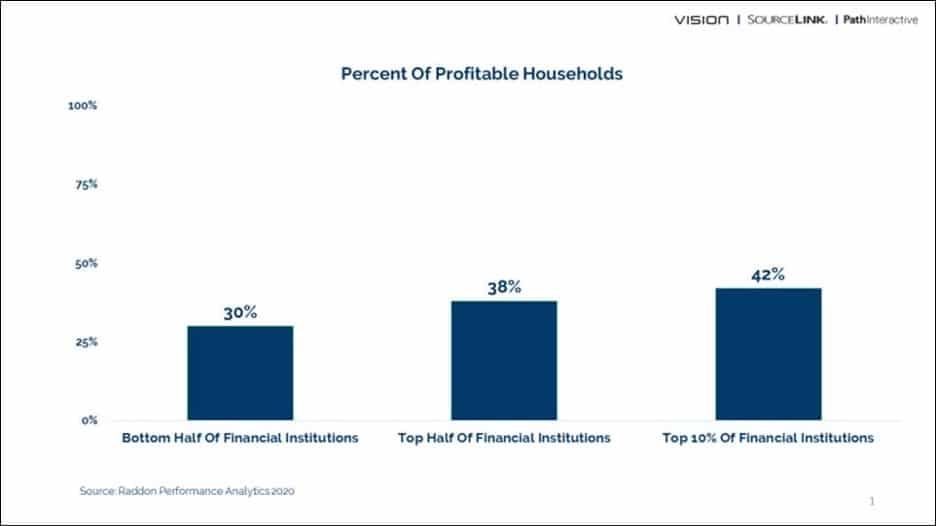

According to 2020 research from Raddon Performance Analytics, only 32 percent of the average financial institution’s customer households are profitable. The other two-thirds are negatively affecting the bottom line.

As you can see in the graphic below, even the top-performing banks and credit unions don’t make a profit from most of their customers — they only profit from 42 percent of these relationships.

It can be tempting to think about customers in terms of the Pareto Principle — the idea that 20 percent of your customers are responsible for 80 percent of your profits. And it certainly is imperative to make the most of every opportunity with your most loyal customers[amsive_tooltip term=”customer-loyalty”]. But this approach can also be fraught with peril.

As the chart above shows, the most successful financial institutions aren’t necessarily the ones possessing a small squad of loyal, high-value customers. They’re often the ones who can turn a greater percentage of their existing customers into profitable ones.

Your current profitable customers who already hold a mortgage, loans and other products should certainly be valued and taken care of. But they may not be the best prospects for additional marketing efforts.

Focus on Key Opportunities

Instead, it can be more beneficial to take an opportunistic approach focused on reaching your customers — profitable and unprofitable alike — at their precise moments of need for your financial services. At any given time, an estimated 2 percent to 4 percent of a bank’s checking account customers are in the market for a loan. But most banks find that less than 10 percent of those customers end up borrowing from the bank, instead turning to competitor[amsive_tooltip term=”direct-competitor”] lenders for products like mortgages, personal loans and installment loans.

Even your best customers aren’t going to book a loan with you when they don’t need one. But a personalized and compelling offer to a currently unprofitable customer at their exact moment of need can quickly turn an unprofitable customer into a highly valued one.

Leverage Your Customer Data

The key to greater profitability lies in leveraging the full possibilities of customer data not just to maximize your opportunities with these profitable customers, but to identify the common threads between your profitable customers and your unprofitable ones. This is how you can determine which of your currently unprofitable customers hold the most potential to become revenue-generating ones.

Even your best customers aren’t going to book a loan with you when they don’t need one.

It all starts with using data to understand the customers in both your profitable and your unprofitable households. Using your first-party[amsive_tooltip term=”first-party-data”] customer data along with Amsive’s customer data, our credit bureau data and other third-party data, you can get a much fuller picture of your customers than you can through your existing data alone.

This picture of your profitable customers will include their demographic and financial attributes, the products and services they have purchased with you, the situations in which they have engaged your bank or credit union for these products, and the offers that led to booked loans. Using this information, Amsive can create high-quality propensity models[amsive_tooltip term=”propensity-model”] that identify your other customers with the most potential to become future profitable customers.

Harness the Power of Propensity Modeling

Using robust and multifaceted data, Amsive can see when these other customers are exhibiting behaviors that mirror those their similar but profitable counterparts demonstrated before they booked their loan, mortgage or other product with you. When you understand these signals, you can act on them to provide exactly the right offer at precisely the right time.

In doing this, your past successes with similar profitable customers can help you provide the most relevant product or service to these prospects. You can combine information on the preferences of these customers and information on what worked with your best similar customers to identify the communication channels and patterns that are most likely to be effective. And you can use proven messaging that is informed by the measurement and optimization of previous efforts to provide offers that resonate.

By using a data-driven, opportunity-based approach toward your existing customer base, you can increase your customer loan growth and reduce your acquisition costs[amsive_tooltip term=”acquisition-cost”]. Instead of using a “spray and pray” approach to try to acquire new customers, you can successfully build deeper and stronger relationships with your existing ones. Through effective modeling[amsive_tooltip term=”modeling”], you will get a much better sense of which customers are truly unprofitable — and which ones are seeds of potential profitability that have yet to bloom.